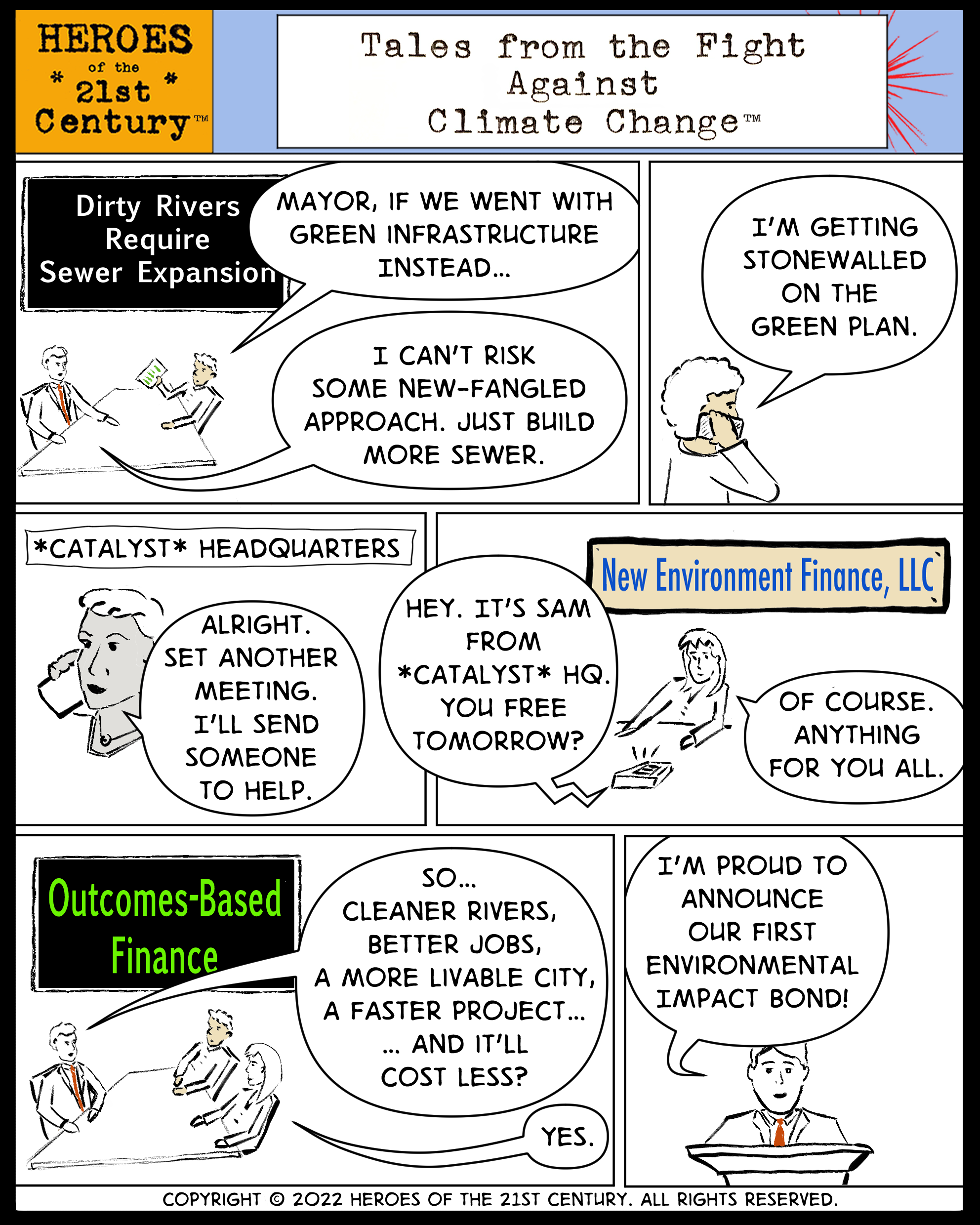

Invoking the Power of Outcomes-Based Financing

Behind the Episode

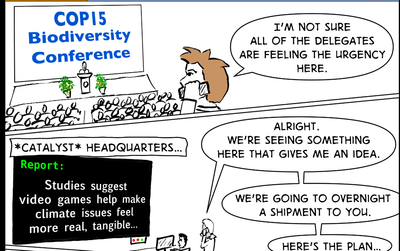

Traditional methods of paying for infrastructure & other projects at the state, city, regional and national levels often discourage leaders from trying new solutions. And so we miss out on innovations that can help advance sustainability, and tame climate change.

Outcomes-Based Financing (also known as Social Impact Investing) flips this dynamic. It harnesses the power of the investment markets to make the innovative environmental projects possible. Indeed, it creates a package of incentives that encourage them.

One example of this is an Environmental Impact Bond. This financing lever has helped cities like Atlanta, Buffalo, and Washington, DC to install green infrastructure, rather than more sewer pipes, as a way to better handle rain water runoff from large storms.

Quantified Ventures created the Environmental Impact Bonds mentioned above (their financial partners in making these happen included Calvert Impact Capital and Morgan Stanley):

More info about outcomes-based / social-impact financing on the website of an organization called Social Finance:

Everything you need to know about social impact bonds & development impact bonds

No spam, no sharing to third party. Only you and me.